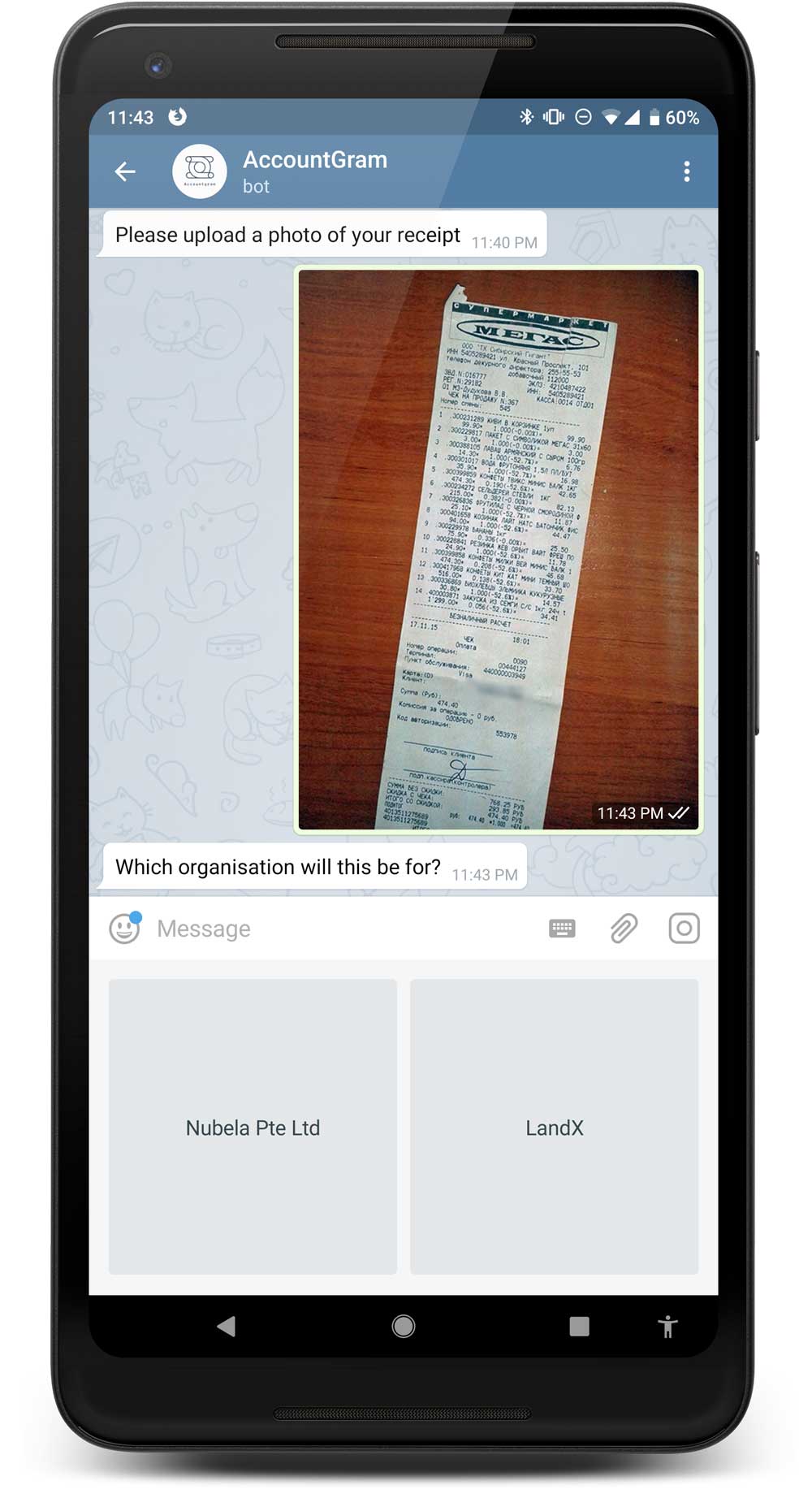

Accountgram is a Telegram Bot to automate book-keeping when you archive receipts

Try Accountgram, it's free!Go back in time to find transactions and export results into a zip file for your auditor

Accountgram is a Telegram Bot to automate book-keeping when you archive receipts

Try Accountgram, it's free!Accountgram is a Telegram Bot to automate book-keeping when you archive receipts

Try Accountgram, it's free!Invite your colleagues and collaborate in uploading receipts for claims and other expenses

Go back in time to find transactions and export results into a zip file for your auditor

Invite your colleagues and collaborate in uploading expense receipts for claims and book-keeping

View an aggregated balance summary of transactions for your organisations

Accountgram is a Telegram Chat Bot

We are not charging any money (for now) as we flesh out the product for you

Try Accountgram, it's free!